- Home

- Investment management

- Fixed income investing

Fixed income investing

Fixed income investments to help you meet your financial goals

If you’re looking for more stable and consistent returns, fixed income investments can play an important role in helping to ensure your portfolio generates a regular income stream.

Fixed income investing can be a valuable tool for diversifying your existing portfolio or more closely aligning your investments with your evolving financial goals, for example, if you want a steady income in your retirement.

Our experienced Investment Managers have been running fixed income portfolios for many years with our tried and tested investment philosophy and can advise you on how to best maximise the potential fixed interest investing offers.

Book your free portfolio review

If you have £100,000+ to invest (including ISAs and pensions) book a free, one hour portfolio review with an Investment Manager.

Rest assured; this is not a sales call. It’s your opportunity to get to know the expert who’d be dedicated to your portfolio, without any obligation to go further.

Your review will cover four important points:

- The reasons why you invest – your situation, priorities and future plans

- Your risk tolerance and the motivations behind it

- The performance of your portfolio and the current balance of investments

- Our recommendations on next steps, including whether fixed income investing suits your goals

Why choose us for fixed income investments?

- A dedicated Investment Manager who works tirelessly to create predictable returns and mitigate risk

- A portfolio tailored to your personal financial goals

- A global approach so you can take advantage of international markets

- Decades of collective experience investing in fixed income markets

- Extensive research and superb insight into fixed income markets and opportunities

- Regular updates on your portfolio’s performance and 24/7 access to your online account

How can I invest in fixed income?

Fixed income investments are an important part of any investment strategy. Depending on your situation and financial goals, our Investment Managers can consider the best approach for you from our range of options below.

Gilt Portfolio Service

If you would like a better rate of return than from a traditional UK bank or building society, our Gilt Portfolio Service offers tax-efficient fixed interest investing through a fully tailored discretionary portfolio of UK short-dated gilts. The service is highly flexible, as we select individual gilts – as many or as few as you need – with maturity dates that match your short-term goals and plans.

Diversified investment portfolio

Your personal Investment Manager can include fixed income investments as part of a diversified investment portfolio, alongside other asset classes such as equities and alternatives, to help reduce the volatility of returns (and in turn, the risk).

Fixed Interest Portfolio Service

Our Fixed Interest Portfolio Service invests in a broadly balanced range of fixed interest funds. By blending these funds, it aims to achieve a net return of 5% per annum that will help to protect you against inflation over the medium term (five years or more).

Fixed income portfolio

Your personal Investment Manager could build a tailored portfolio of fixed income investments that is exactly suited to your needs and feelings about risk, as well as your preference for investing in sterling, US dollars or euros.

Fixed income investing – your questions answered

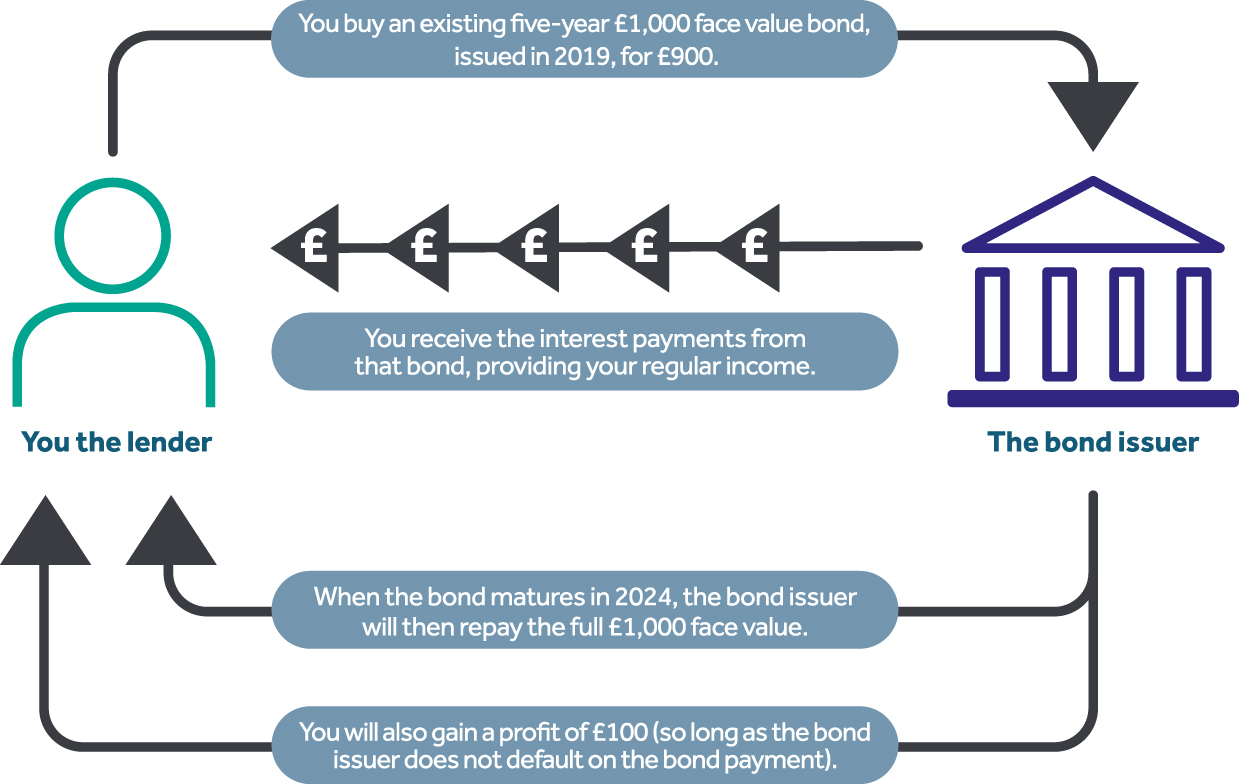

Fixed income or fixed interest investments relate to instruments issued by governments or corporates as an effective way for them to borrow money – i.e. they are a source of credit. They are designed to be a lower-risk way to generate a set amount of annual income.

Fixed income investments include:

- Government bonds – government issued debt with a set redemption date and fixed interest. Sometimes referred to as ‘sovereign debt’ internationally or as ‘gilts’ in the UK

- Corporate bonds – loans issued by corporate entities with solid balance sheets. Investors receive annual payments (coupons) and get their capital back at the end of the investment term (as long as the company does not default)

- International corporate bonds – debt issued internationally, offering attractive long-term opportunities.

Yes, fixed income investments are considered to be lower risk than many other forms of investment.

Bonds, historically, have a low correlation to equity performance, so can help to provide a more stable income stream in times of volatility. While fixed income investments aren’t without risk, our specialists mitigate risk further by selecting good quality fixed income funds and short-dated bonds.

- To diversify your portfolio to reduce the volatility of returns (and thereby the risk) by investing across different asset classes

- To generate a steady income stream

- To produce capital gains (potentially)

- For a more certain return of capital

- To use the fixed annual income to offset fixed liabilities

There are various different ways to generate fixed income from your investment portfolio. As we have deep expertise and experience in fixed income investing and can access a wide range of bonds and gilts directly or via funds, we can use different approaches based on your individual income requirements:

- Bond ladders: A portfolio of bonds maturing regularly, for instance from two to 12 years; as the shorter-dated bonds redeem, proceeds are reinvested longer term

- Cash flow modelling: A portfolio of bonds providing regular income and certainty of capital return aligned to your schedule of known monthly outgoings; this allows you to manage your annual income needs

- Discount investing/grossing up return: Investing in deeply ‘discounted to par’ corporate bonds or gilts, where a large part of the total yield to redemption is capital gain (which is generally tax free for most UK individuals investing in qualifying corporate bonds).

- For example, the UK Treasury Gilt 0.125% with a maturity date of 31 January 2026 is trading at £94.98 and will yield c.3.63%; or the UK Treasury Gilt 0.125% to be redeemed on 31 January 2028 is trading at £88.86 and will yield c.3.55%.

How much you invest in fixed income depends on your individual circumstances and financial goals. Our Investment Managers can recommend the best way forward for you based on your situation. For our Fixed Interest Portfolio Service, there is a minimum investment of £50,000.

Now could be a good time to incorporate fixed income investing into your investment strategy, particularly if you’re starting to plan for retirement and looking for more stable returns.

Since 2022, core bond markets have experienced some of the greatest annual falls in modern history. In some cases, bond prices fell so far that their market price is now well below their face value, creating the potential for attractive long-term total returns.

To find out more, watch our summer investment webinar, in which Thomas Becket, from our Chief Investment Office, discusses why fixed income investing could still be an attractive alternative right now.

Book a free consultation

Arrange a no-obligation, complimentary consultation with one of our fixed income investing specialists.

Investment involves risk. The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

Our Fixed Interest Portfolio Service is designed to work over a typical investment cycle of five years or more, so we recommend you stay invested for at least five years.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

Book a free consultation with a fixed income investment advisor

What happens next?

1. Arranging an initial consultation

First you can expect to receive an email from our team within 48 hours to find a suitable time that works for you, to arrange a voice or video call for an initial consultation.

2. Your consultation

During this consultation, a member of the team will discuss your situation with you to understand your requirements and answer any questions you might have about Canaccord Genuity Wealth Management and the services that we provide.

3. Referral to a Wealth Planner or Investment Manager

If you decide to progress with us, you will be referred to one of our Wealth Planners or Investment Managers to discuss your situation and requirements in more detail. They will then design a bespoke proposal detailing a unique investment portfolio that matches your individual requirements and attitude to risk, to meet you and your family’s needs.

4. Working with you long-term

With our wealth planning and investment management professionals, your wealth is in expert hands. Our mission is simple - to help you build your wealth with confidence. We will always keep you informed about your investment portfolio and performance and will continue to work with you to build our relationship on your terms. We can meet with you face-to-face, by phone or by email, whichever is more convenient for you. You can also access your account online at any time through our app. Our wealth management professionals are always readily available to speak with you.

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.