The smart investor’s guide to the economic cycle

Thomas Hibbert, Multi-Asset Strategist at Canaccord Wealth, explores the different phases of an economic cycle, the role of interest rates and how long-term portfolio building throughout the cycle can be an effective way to manage investment risk and boost returns.

What is an economic cycle and how does it affect your portfolio returns?

Economic cycles refer to the ups and downs in economic activity over time. At Canaccord Wealth, we cannot avoid being affected by economic cycles, but we can control how we invest on your behalf during each phase.

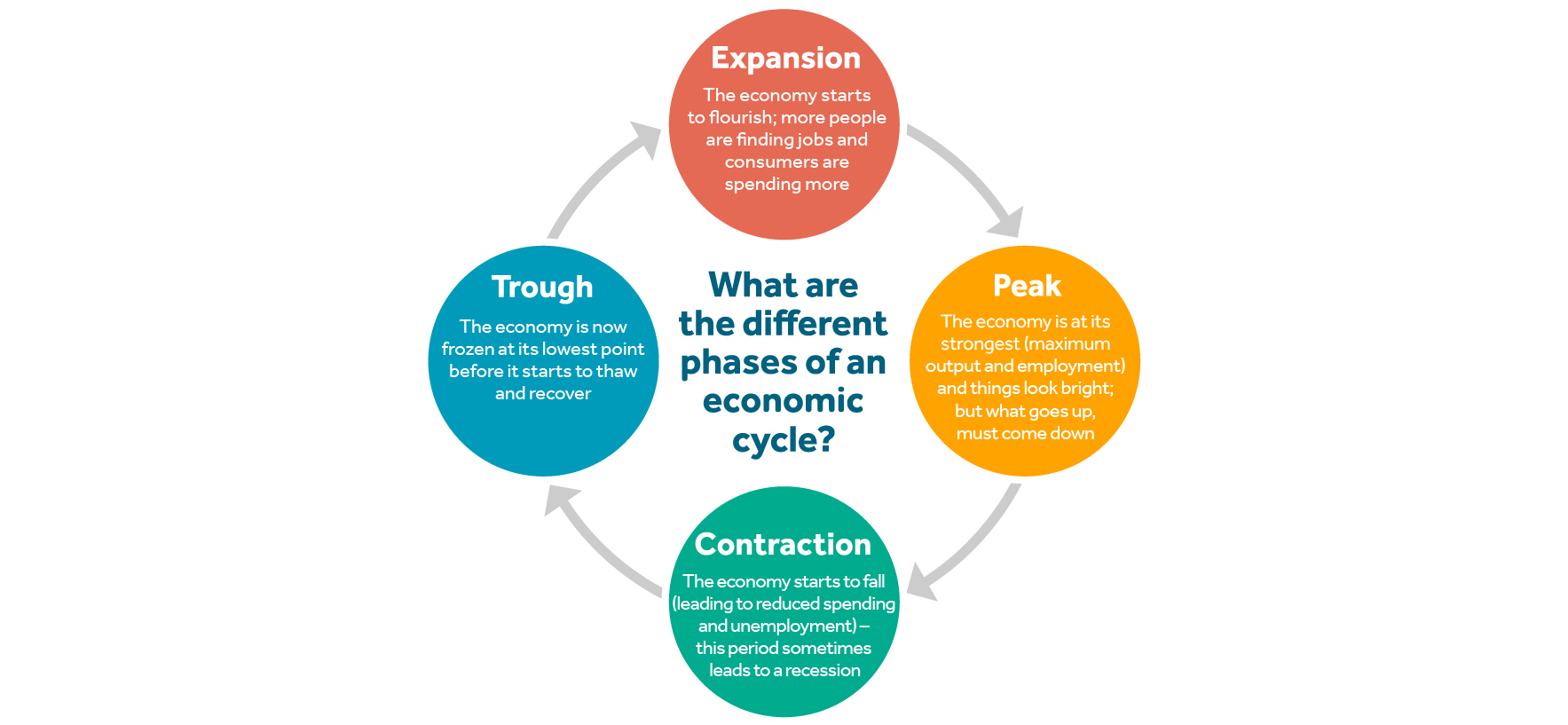

What are the different phases in an economic cycle?

Think of the phases in an economic cycle like seasons, although we don’t experience them all in one year – the average economic cycle normally runs for five years.

What impact do interest rates have on economic cycles?

Set by central banks to stabilise the economy, interest rate changes are designed to significantly influence economic cycles.

Central banks typically raise interest rates to control inflation during economic expansion; they generally lower them to stimulate growth during downturns.

These interest rate adjustments affect borrowing costs, consumer spending and business investment, thereby affecting the overall economic cycle and the opportunities available to investors.

How can you manage equity investment risk during economic fluctuations?

Different types of assets benefit during different phases in the cycle.

Equities perform well during the expansion phase, but poorly in the contraction phase - sometimes declining significantly. During the global financial crisis of 2008, the FTSE All World Index of global equities declined by 58%1. Equities tend to take longer to fully recover compared to other asset classes but offer the most attractive return over a full cycle.

If you have a medium-term investment horizon, a typical equity market drop is intolerable. Therefore, spreading investments across equities, bonds, cash and alternatives such as gold and commodities (more on alternatives below) can help balance risk and reward within your portfolio based on how long you plan to invest. This strategy aims to keep drawdowns (the decline in the value of an investment from its highest point to its lowest point) within acceptable limits and align the average time it takes to recover from losses within your investment horizon.

For short-term goals, a conservative strategy that allocates more money to bonds, alternatives and cash helps to reduce risk. In contrast, for those clients with long-term goals, a riskier approach may be suitable with a larger portion invested in equities as you can tolerate more short-term volatility and aim for higher returns over the long term.

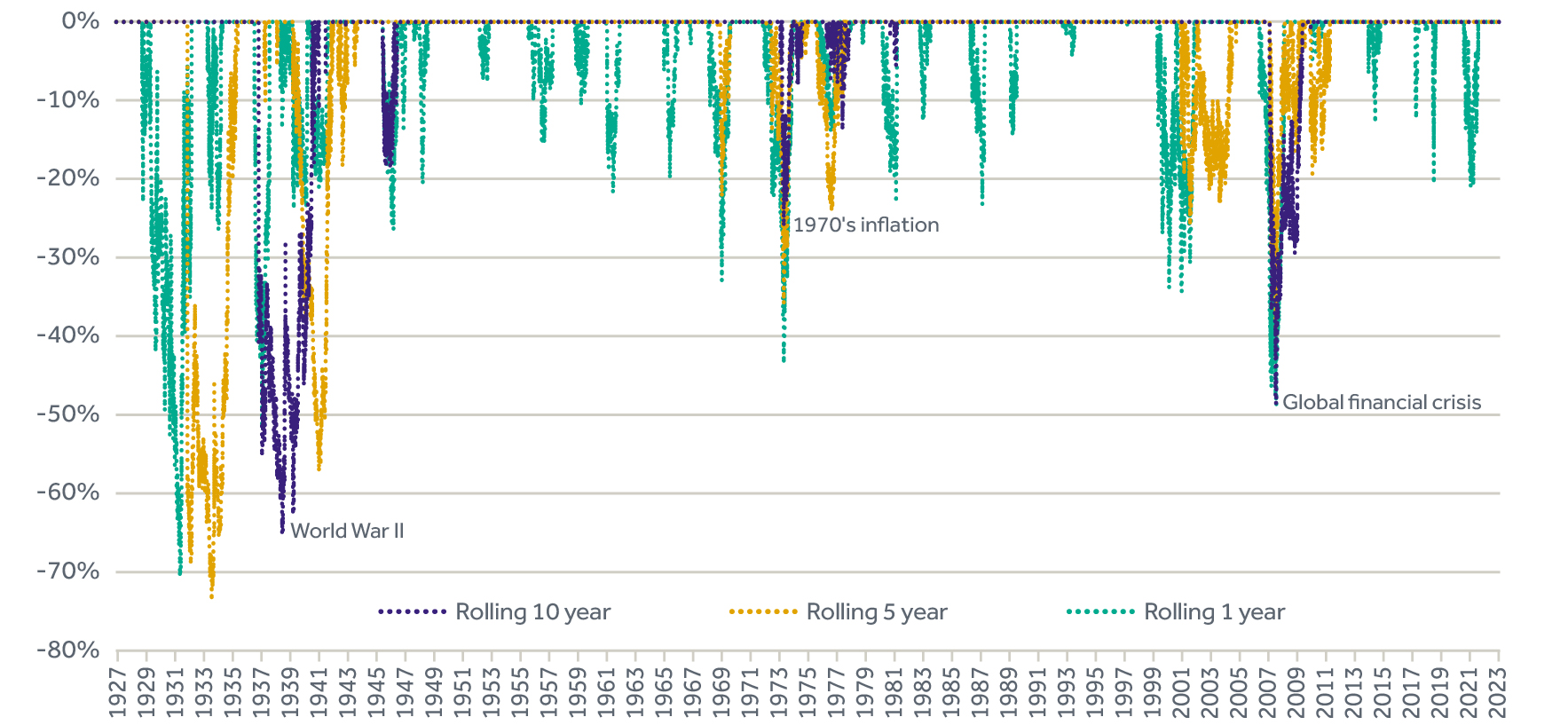

The longer you stay invested in equities, the less risky they become. As illustrated in the chart below (fig 1), over the past century negative US equity returns over 10 years (rolling 10-year data shown in purple) have been rare, although over shorter time frames, equity markets often show negative returns.

Fig 1 Rolling returns in US equity market over one, five and ten-year periods

In the past hundred years, the US equity market recorded only three periods of negative 10-year returns: World War II, 1970s inflation, and the global financial crisis.

Source: Bloomberg

How can active investment portfolio management help during different economic phases?

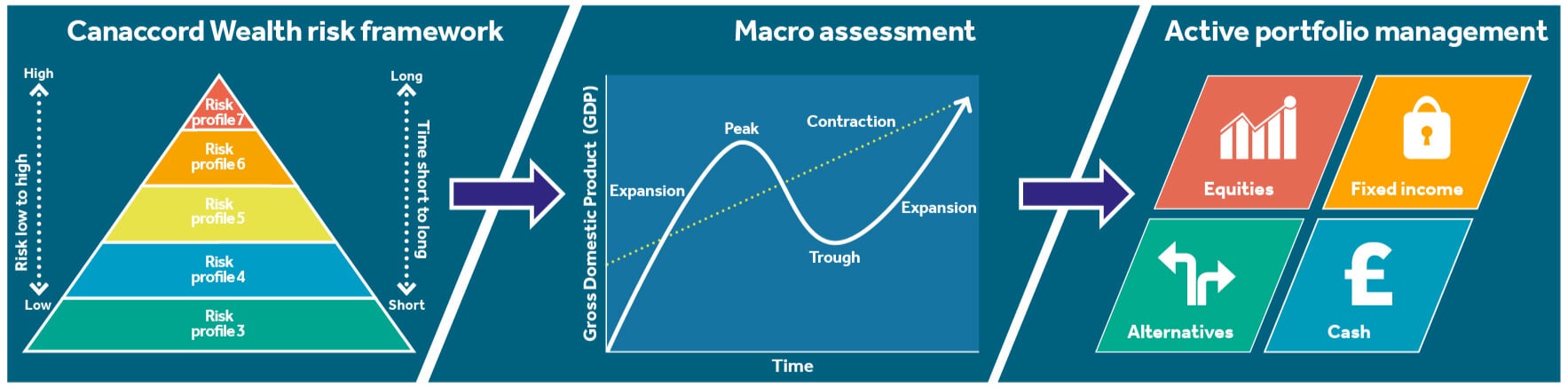

At Canaccord Wealth, we aim to deliver the best risk-reward balance throughout the economic cycle, catering to our various client investment risk appetites.

Each cycle is unique and will impact asset volatility and how each asset class performs in relation to one another (known as correlations). As active multi-asset investors, these elements guide our rigorous risk management approach, and we adjust our asset allocations accordingly. Our strict risk profiling framework is also designed to avoid human biases and unexpected outcomes.

Fig 2 Our strategic investment framework

What are the active portfolio management levers you can pull?

At Canaccord Wealth, we tend to focus on the following asset classes:

Lever 1: Equities

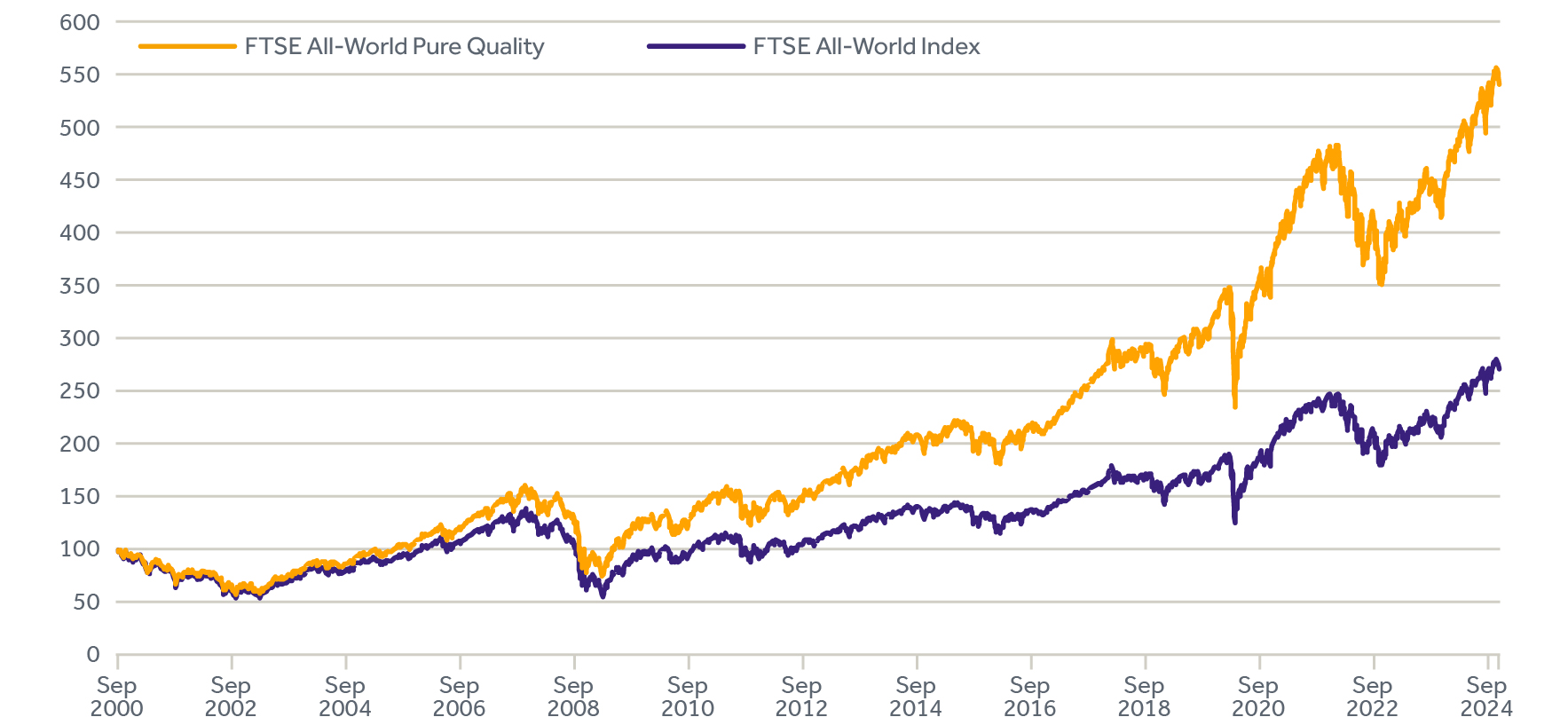

- We focus on high-quality companies, considering their strength, value and diversification benefits

- Historically, investing in quality companies has provided better returns with lower risk compared to the broader equity market

- Quality companies with steady earnings, strong balance sheets and a competitive edge tend to perform better during market downturns.

The graph below (fig 3) shows the historic return of quality equities against the broader market.

Fig 3 Quality equity returns vs FTSE All-World Index

Source: Bloomberg

Lever 2: Fixed income

Fixed income assets, or bonds, play an important role in a balanced portfolio, although the specific type of asset we choose to invest in can change during the economic cycle:

- Our goal when investing in fixed income assets is to deliver strong returns over a cycle while providing stability in a multi-asset context during the contraction phase.

- Understanding the interest rate cycle is key to fixed income investing: when interest rates rise (typically during the expansion phase), bond prices fall; we aim to reduce interest rate risk and focus on higher yielding areas of fixed income to enhance returns, often taking more credit risk (the risk of default). For more information on fixed interest investing and what we mean by credit risk visit our glossary of terms here.

- When economic activity slows, central banks tend to lower interest rates to stimulate growth; this stage in the economic cycle is usually best for traditional fixed income assets, such as government and high-quality corporate bonds.

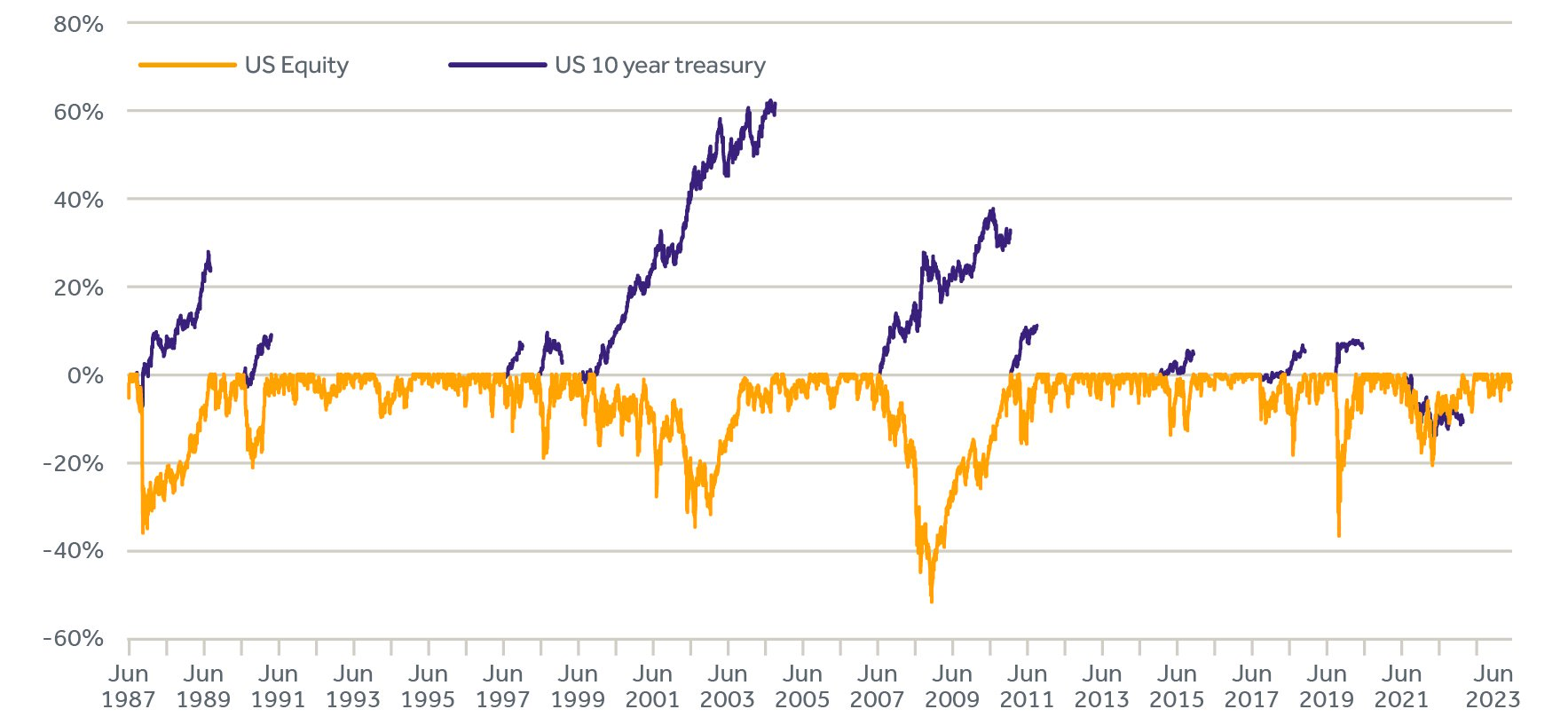

The graph below (fig 4) illustrates how investing in US treasury bonds, since the 1987 stock market crash, has offset equity market drawdowns (as explained above) of 10% or more. We prioritise this diversification characteristic across our fixed income allocations when risk of recession is elevated. During the 2022 inflation surge bonds failed to diversify equity risk, as you can see below, resulting in the worst year on record for multi-asset investors.

Fig 4 US treasury bonds vs US equities

Source: Bloomberg

Lever 3: Alternatives

Alternatives bring some different qualities to a portfolio:

- We aim for low correlation with traditional assets and focus on strategies that diversify when equities and bonds are falling together, usually during inflationary regimes typically seen towards the end of economic cycles

- Our preferred strategies should aim to deliver returns above cash with moderate volatility while prioritising downside protection for our clients with a lower risk tolerance and shorter investment horizons

- Alternatives can be expensive with a performance fee often charged on top of a management fee; we prefer cost-effective, proven strategies, often using a multi-strategy or systematic approach.

Make sure you keep riding the economic cycle

Understanding the economic cycle and its impact on your investment portfolio is crucial for effective investment management and returns.

By adjusting your portfolio allocation based on economic conditions, and diversifying across different asset classes, we can better navigate market fluctuations and help our clients achieve their financial goals in a predictable fashion. By staying adaptable and diverse, we can confidently ride the economic cycle.

Any questions?

If you would like to discuss any of the themes raised in this article, in relation to the asset allocation within your portfolio, please get in touch with your usual Canaccord account executive or email: questions@canaccord.com

For further information on any of the terms used in this article please see our glossary of investment terms.

Our investment outlook for December 2024

Read our latest investment outlook, where we evaluate the economic and geo-political landscape of 2024 while looking ahead to investment opportunities in 2025.

You may also be interested in:

New to Canaccord?

If you are interested in finding out more about our tactical portfolio allocation, we can put you in touch with an expert for a no-obligation, free consultation.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only.

The information contained herein is based on materials and sources deemed to be reliable; however, Canaccord Wealth makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. Canaccord Wealth is not liable for the content and accuracy of the opinions and information provided by external contributors. All stated opinions and estimates in this article are subject to change without notice and Canaccord Wealth is under no obligation to update the information.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.