Investing in gilts for tax-efficient returns

This article was written by Kay Bendall and originally published on Adam & Company.

When it comes to your cash savings, make sure you mind the gap!

Higher interest rates – mortgage holders may hate them, but savers love them.

Now that inflation is falling back, the interest rates available for savers are pulling ahead of the rate of inflation. But it’s vital to ‘mind the gap’ between the headline rate you’re offered and the rate you’ll actually receive after tax.

This is especially true if your earnings mean you’re in a higher-rate tax band, as interest income that takes you in to the UK higher rate tax band is taxed at the higher tax rate, once you’ve used your personal savings allowance. Your earnings tax band also impacts your tax rate for capital gains and dividends received from shares.

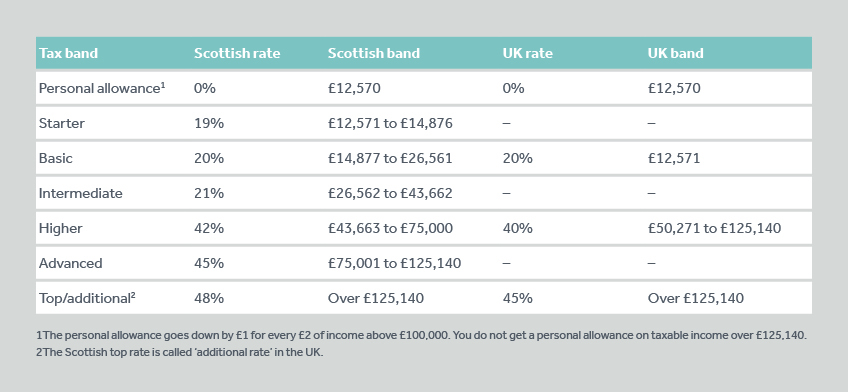

This has become increasingly complex in Scotland in the 2024/2025 tax year, as there is a wider divergence with the rest of the UK with more Scottish income tax bands and higher income tax rates. These bands also have lower thresholds than in the rest of the UK: the threshold for paying 42% tax in Scotland is income of above £43,662, which steps up to a 45% tax rate over £75,000 and a 48% tax rate over £125,140.

Set against this is a modest personal savings allowance at which you do not pay tax on Interest income. For a basic-rate tax payer this allowance is £1,000 and for a higher-rate tax payer it’s £500. So if you’re a basic-rate tax payer with over £20,000 in a savings account paying 5% interest, or over £10,000 for a higher-rate tax payer, the interest on your savings will start attracting tax.

Bridging the gap to maximise your savings with tax-efficient solutions

Luckily, there are tax-efficient savings opportunities that you can, and definitely should, use.

- Using your annual ISA allowance – the annual ISA allowance is still £20,000 in the 2024/2025 tax year – and of course, interest on savings in an ISA is tax free. However, many people opt for using their ISA allowance for their shares rather than their cash, as shares in ISAs have a double tax advantage, as they don’t attract tax on either the income they generate or the capital gains they create. The government is currently considering a new ‘British ISA’, but we have yet to hear what extra share investment opportunities this will create.

- National Savings options – there are also some tax-free National Savings options, including Premium Bonds, although their interest rates usually lag behind those offered on savings accounts. From the March 2024 draw onwards, the Premium Bond prize fund rate has been set at 4.4%.

These are just a few examples, but an expert CGWM Wealth Planner could advise you on other tax-saving options or bespoke investment plans. We can work with you to make the most of tax-efficient opportunities and ensure you are not paying more tax than you need.

Tax-efficient fixed income investing

Yet another tax-efficient option is fixed income investing through low-interest, short-dated UK government bonds (known as gilts). These are relatively low risk, as the UK government has never failed to repay its domestically issued debt. They are similar to fixed-term cash savings options, as they have a preset known maturity date and fixed redemption value. However, if you don’t hold them to maturity, the value of the investments can go down as well as up.

The attraction of this kind of investment right now is that many short-dated gilts can currently be bought for a price below their redemption value. This means you can expect to earn more than simply the interest payments; you could also make a profit by buying a gilt at less than its face value and then receiving the full value from the government when it matures.

How this helps your tax bill

If you are a UK taxpayer, this creates an opportunity to make capital gains without paying capital gains tax (CGT), creating particularly attractive gross returns for higher-rate taxpayers.

While the interest paid counts towards your taxable income, the capital uplift when you sell the gilt is not taxed, as there is no CGT on gilts. This means that a gilt has a much smaller gap between the headline return and the actual return than a cash savings account does.

For example, if you are paying 20% tax on your savings income, a 4% return from a gilt in which 98% of the return is via a capital uplift equates to well over a 5.5% interest rate on cash savings. And if you’re likely to be in the new Scottish advanced or top-rate tax bands of 45% or 48% and paying 40% tax on your savings income, your taxable savings account would need to offer close to 7.5% interest to provide the same return as the gilt.

Speak to one of our experts about investing in gilts

If you would like to know more about how investing in gilts could improve the return on your savings, please get in touch. We’ll be happy to talk to you about our Adam & Company Gilt Portfolio Service and how it could fit in with (and enhance) your other financial arrangements.

Find this useful? You may also be interested in:

Speak to our team

If you are new to CGWM, find out how our investment experts can help you build a diversified portfolio.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only.

The information contained herein is based on materials and sources deemed to be reliable; however, Adam & Company makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. Canaccord is not liable for the content and accuracy of the opinions and information provided by external contributors. All stated opinions and estimates in this article are subject to change without notice and Adam & Company is under no obligation to update the information.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.