US election: ‘Two bowls of poison’ or a formula for progress?

As the old (since the Wall Street Crash) saying goes, ‘When America sneezes, the rest of the world catches a cold’. It may feel as though the US is a long way from the UK, but the looming election has important implications for all of us.

In this article, we investigate the different policies of the two contenders, Donald Trump and Kamala Harris, and the effects they could have on financial markets, inflation, interest rates, geopolitics and more.

Why you should stay invested no matter who’s US president

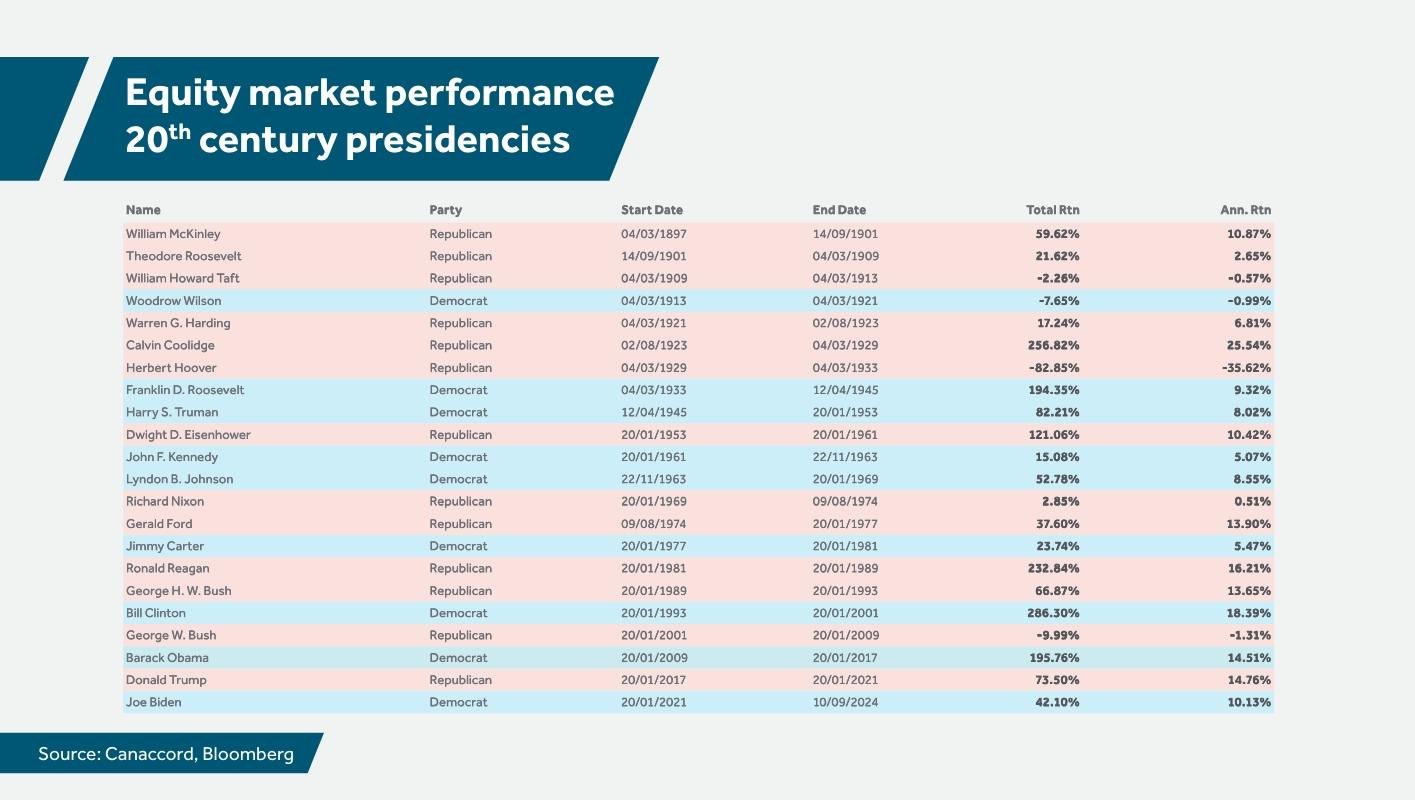

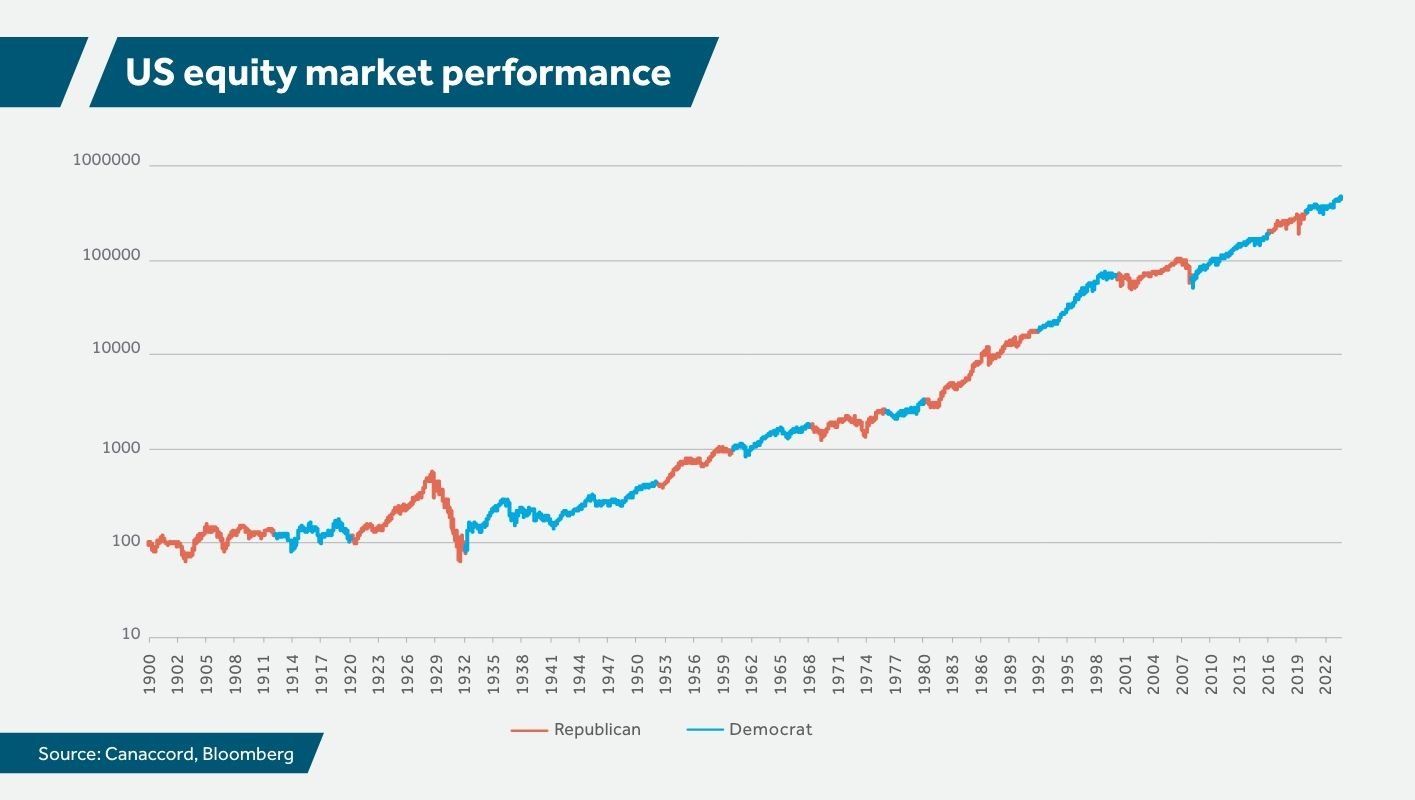

An analysis of equity market performance during 20th-century presidencies, as shown in the table and graph below, demonstrates little difference between Republicans and Democrats.

The average annual return of the US equity market during Republican presidencies was 6.0%, compared to 8.7% for Democratic presidencies. The median annual returns were 10.4% for Republicans and 8.6% for Democrats.

For the first 33 years of the 20th century, including the boom and bust of the Roaring Twenties and the Great Depression in the 1930s, equity markets made very little progress. This period was predominately overseen by Republican presidents, except for Woodrow Wilson, a Democrat who held office during WW1.

From 1933 onwards, equity markets enjoyed substantial gains, with a more equal share between Democrat and Republican presidents. From a market perspective, the timing has almost entirely been in favour of the Democrats, with Bill Clinton riding the tech boom of the late 1990s, handing over to George W. Bush just in time for the bubble to burst. The Bush presidency ended in early 2009 during the global financial crisis.

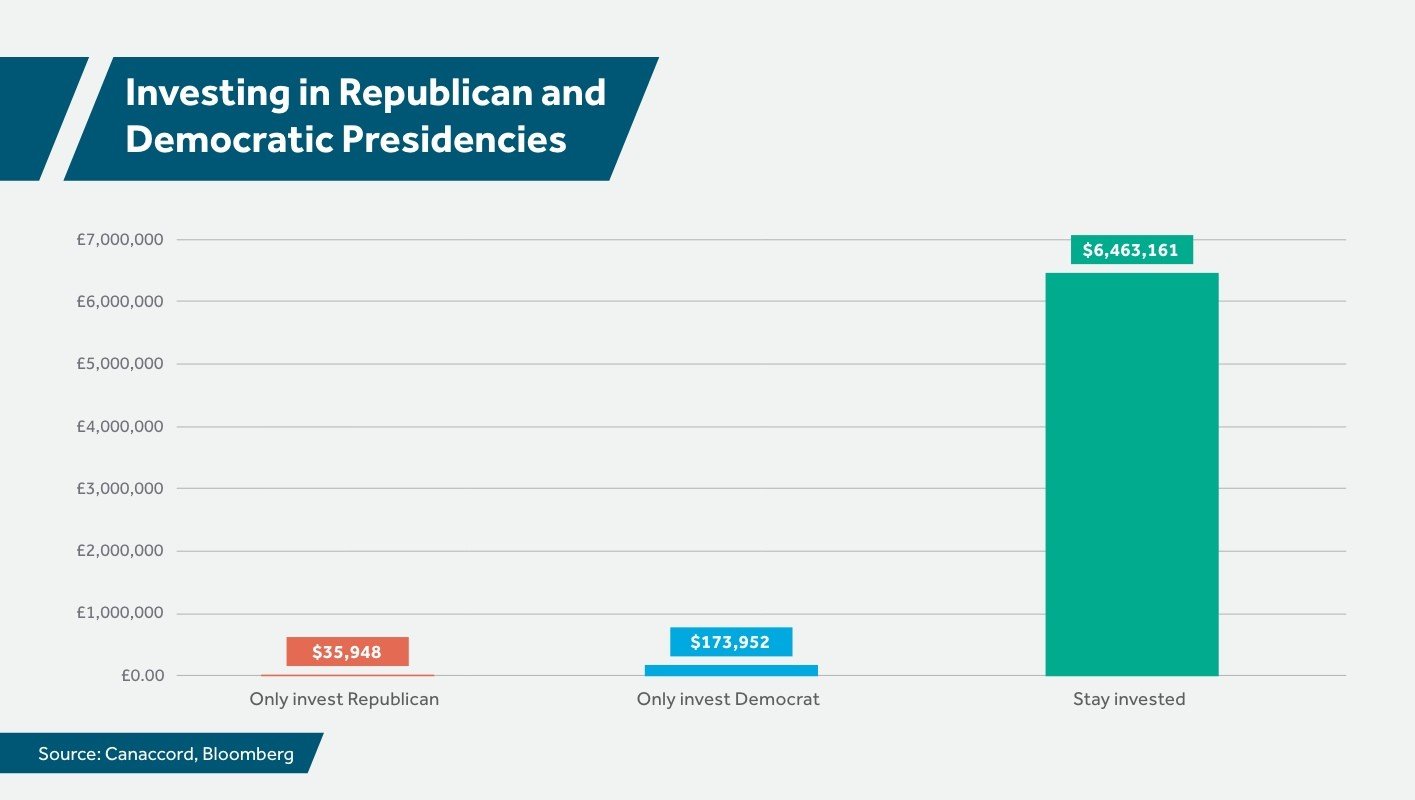

No matter who’s president, equity markets have positive expected returns. The graph below shows that:

- $1,000 dollars invested in the US equity market at the inauguration of William McKinley in 1897 would be worth $6.5 million today

- If it was invested only during Republican presidencies, it would be worth just US$36,000

- If only during Democratic presidencies, it would be worth US$174,000.

The graph shows that staying invested and leveraging the power of compounding is more important than reacting to short-term market volatility. Try not to let politics get in the way.

US presidential candidates: a popularity contest

At the time of writing, the polls show Harris leading Trump. Since President Joe Biden dropped out, Harris has captured renewed enthusiasm from voters, particularly younger demographics, increasing the chances of the Democrats taking the House of Representatives.

Congress (made up of the Senate and the House of Representatives) is, however, likely to be divided, which would make legislation tougher to pass and campaign proposals harder to deliver.

The Senate map favours the Republicans, as the Democrats are defending most of the seats up for re-election. If Harris wins, she will probably have to contend with a Republican-controlled Senate.

Key policy differences

Trade

Trump’s trade tariff proposals have the most significant market implications and go considerably beyond the focus on China during his first term. Trump plans to implement a 10% tariff on imports globally and raise the tariff on China to a whopping 60%. Trump does not need congressional approval to implement these policies (he could impose them on grounds of national security as he did before).

Trump has also proposed phasing out Chinese imports and tightening regulation on critical technologies such as semiconductors. These policies would increase the overall tariff rate to the highest since the 1930s, significantly raising inflationary pressures and damaging American consumers. The EU is also a target for Trump’s trade wars, due to its large trade surplus with the US.

Given Trump’s distinctive individual style, the uncertainties surrounding trade policy make it possibly the most significant risk factor for financial markets.

Economy

Harris plans to increase taxes on high-income earners and raise the corporate tax rate from 21% to 28%. Although this would crimp corporate earnings, it could be a challenge to pass, given the likely Republican control of the Senate. She should receive less backlash against her plans to increase small business tax breaks and tax cuts for individuals making less than US$400,000 a year.

Trump plans to cut corporate tax, possibly to 15%, boosting corporate earnings and supporting markets. He will also prioritise a deregulatory agenda to stimulate growth and business activity.

Energy and climate

The Republican slogan, ‘Drill, baby, drill’ highlights another area of differentiation. Trump would seek to promote domestic oil and gas production while rolling back clean energy initiatives.

Meeting emissions reduction targets set out in the Paris Agreement will not happen under Trump and will be unlikely under Harris, particularly given growing electricity demand. Trump might withdraw from the Agreement and leave the UN Framework Convention on Climate Change, making it more difficult for a future administration to rejoin.

On the other hand, the Democrat party’s ‘Inflation Reduction Act’ (IRA) could remain unscathed, as Republican states benefit most. Harris wants to increase support for clean energy, extending IRA initiatives while tightening regulations on oil and gas, alongside continuing Biden’s pro-electric-vehicle policy.

Immigration

The Democrats have been unable to control the southern border and the US immigration system is broken. Trump would use executive powers to restrict immigration and increase efforts to deport illegal immigrants, while Harris would continue with Biden’s softer approach, focusing on diplomatic efforts with Mexico and seeking bilateral legislation in the Senate.

Fiscal responsibility

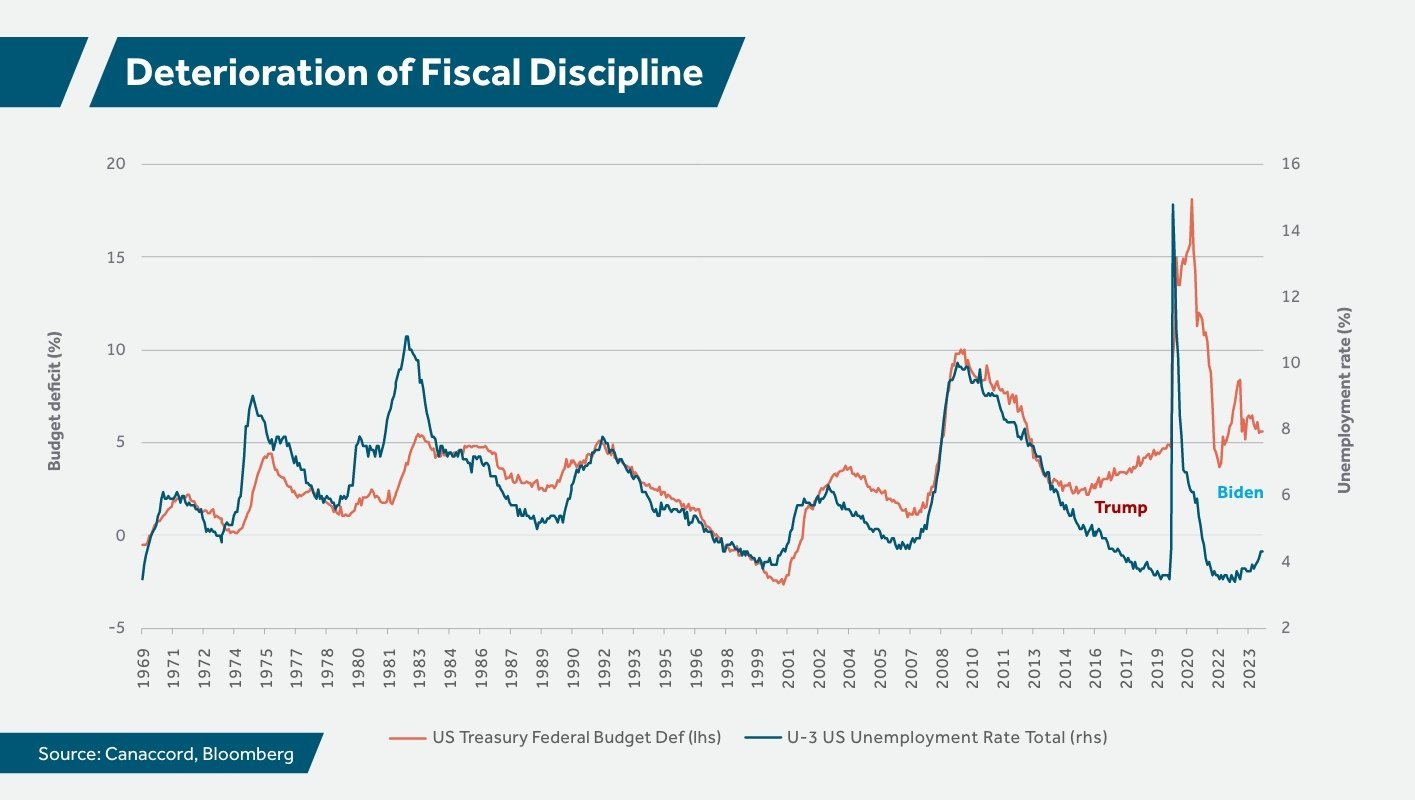

Since 2015, the US has been running an unsustainably large budget deficit, and fiscal discipline has deteriorated under both Democrat and Republican presidents. More spending is already embedded by existing policy.

Historically, the scale of the budget deficit has been closely related to the health of the economy. The graph below shows this relationship through the lens of the unemployment rate.

Trump’s fiscal proposals mostly include tax cuts, which he hopes to offset by increased tariffs, although these have potential inflationary implications.

Harris proposes to increase spending on care and cut taxes for those earning less than $400,000. Her offsets include raising taxes, including the corporate rate to 28%, which would be difficult to pass without a Democratic Senate, which is unlikely.

Both proposals are fiscally irresponsible, particularly given the country’s ballooning $35tn debt and rising interest costs.

Economic outcomes of the US election

Inflation

‘Trumpflation’ (inflation linked to Donald Trump's policies) has plenty of evidence behind it, and inflation may well be higher under him. Trade tariffs could affect US households, while his policies on immigration would remove a source of cheap labour. He plans to control inflation by ramping up fossil fuel production, which makes some sense in the light of rising geopolitical tensions in the Middle East. Nonetheless, energy prices have come down substantially from their 2022 highs.

Harris’ policies, mostly inherited from Biden, are broader, including efforts to improve housing supply and affordability, but congressional approval could prove difficult. Her proposal to ban ‘price gouging’ may not have any significant impact and has been criticised by economists. Other policies are more popular, including antitrust legislation on institutional landlords.

Growth

Trump is generally considered the growth candidate, thanks to his proposals to deregulate banks and industry, increase energy production and cut taxes, improving the landscape for corporate growth. However, some of his policies, particularly on trade but to a lesser extent immigration, would probably raise inflationary pressures and diminish growth.

Harris’ policies would be more difficult to enact with a divided Congress. Her stricter controls over oil and gas and regulatory oversight over the financial sector, her focus on labour rights and unionisation, and her proposals to increase taxes would create a headwind for growth and corporate earnings.

Interest rates

With growth and inflation likely to rise under a Trump administration, interest rates would also be higher. Trump has threatened the independence of the Federal Reserve (Fed), although he’s unlikely to succeed.

In his view he would be better at setting interest rates than the Fed as he has a ‘better instinct’ than policy makers. If Trump did gain control of monetary policy, he would be biased towards lower interest rates, which could fan the flame for further inflation.

International alliances

The US has lost its appetite for international affairs, with Trump potentially pulling back from international alliances such as NATO, and Biden’s fraught exit from Afghanistan.

Trump’s ‘America First’ slogan is popular with certain people, but the US is navigating the possibility of a second Cold War and the era of globalisation is at an end.

China

Relations with China have soured, and Trump’s proposed tariffs would damage the Chinese economy, creating further friction.

The Biden administration has focused on managing competition without conflict. Recent efforts have included resuming military-to-military dialogue, expanding cooperation on renewable energy, and addressing issues like fentanyl trafficking – but the relationship remains precarious, with deep mutual scepticism and tensions over Taiwan and technology.

Ukraine

Trump has pledged to end the war in Ukraine, and he may be able to bring both parties to the negotiating table. However, his strategy is opaque and possibly non-existent.

Both Russia and Ukraine must make concessions, and for Ukraine this means territory. This comes with uncertainty and the risk of escalation.

The situation in Kyiv has deteriorated, as Ukraine faces growing economic and military challenges. Despite bold actions, Russia’s advances and destruction of Ukraine’s infrastructure have taken a toll. National unity is waning, and Ukraine remains vulnerable to Russia’s aggression.

NATO’s aid is currently insufficient, making US decisions crucial. Biden is unlikely to fully support Zelensky’s strategic plan in his remaining time in office, while a Harris presidency could doom Ukraine to defeat. Trump’s potential victory presents a choice between conceding to Russia or escalating Allied efforts.

Middle East

War is escalating in the region, involving Israel, Iran and its proxies. The US, with its long history of support for Israel, must balance its military commitments with diplomatic efforts to stabilise the region and prevent further escalation.

Trump is a staunch supporter of Israel. He has criticised the Biden administration’s handling of the Israel-Hamas conflict and claimed that it would not have occurred under his presidency. He has called for Israel to ‘finish the problem’ with Hamas, and promised continued support if re-elected.

During his first term, Trump brokered the Abraham Accords, which normalised diplomatic relations between Israel and several Arab countries, including the UAE, Bahrain, Sudan, and Morocco. These agreements were significant diplomatic achievements.

Within the Democratic party, some are more sympathetic to the Palestinian cause. Progressive Democrats have been vocal about the need for a ceasefire and addressing the humanitarian crisis in Gaza. The party remains divided, with moderate and conservative members generally maintaining stronger support for Israel. Harris’ stance balances Israel’s right to defend itself with the humanitarian concerns of the Palestinian people.

Financial markets

Markets may continue their upward trend irrespective of who takes office, while fiscal policies under either administration are likely to exacerbate the budget deficit.

However, the policy differences between Trump and Harris could lead to varied outcomes in trade, inflation, economic growth, global stability and market performance. The uncertainty surrounding Trump’s governance style presents higher tail risks for financial markets and global relations. His trade tariffs and protectionist agenda pose inflationary risks, while his deregulatory stance and tax cuts may stimulate growth, implying a better environment for equities.

The bond market may favour Harris, as she represents the status quo and predictability, particularly when it comes to issues such as the independence of the Fed. Harris will probably find it more difficult to enact her agenda against resistance from a divided Congress, but higher taxes and a more regulatory agenda would crimp corporate earnings.

The upcoming US election presents significant implications for global markets and geopolitical dynamics, with both Donald Trump and Kamala Harris offering generally starkly different policy proposals. Regardless of who takes office, historical trends suggest that long-term equity market growth is likely to continue, with other variables outside of US politics having a greater impact on financial market returns underscoring the importance of remaining invested.

If you think you could benefit from the information in this article or have your own thoughts on the upcoming US election, please get in touch.

For further information on any of the terms used in this article please see our glossary of investment terms.

You may also be interested in:

- Is there a perfect time to invest?

- Our Investment Outlook

- Has election fever positively impacted our client investment portfolios?

New to Canaccord?

If you are new to wealth management and would like to learn how this can benefit you, we can put you in touch with our team of experts that can help.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance. The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity. This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only. The information contained herein is based on materials and sources deemed to be reliable; however, Canaccord Genuity Wealth Management makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. Canaccord is not liable for the content and accuracy of the opinions and information provided by external contributors. All stated opinions and estimates in this article are subject to change without notice and Canaccord Genuity Wealth Management is under no obligation to update the information.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.