Whole of life cover: The 'secret’ inheritance tax mitigation tool

With the upcoming budget creating speculation on changes to inheritance tax (IHT), it’s challenging to know where to start with your estate planning.

When it comes to planning for an IHT liability, the first question to ask yourself is ‘what is my motivation?’

Our clients often tell us they are focussed on simply not wanting to pay IHT. This is understandable, given the tax they’ve already paid while building their wealth. However, when we dig a bit deeper, even more understandable is that they really just want to pass on as much money as possible to their loved ones.

With this meaningful goal in mind, we can explore a highly effective, but often overlooked, means of mitigating IHT - one which we believe is unlikely to be impacted by changes to wealth taxes. This ‘secret’ financial planning tool is a whole of life assurance policy, sometimes called whole of life cover, or whole of life insurance.

Hazel Bowen, Senior Wealth Planner, explains more in this article.

What is whole of life cover?

Whole of life cover is a life assurance plan that pays out a guaranteed amount of money when you die*. The cover lasts for the rest - or whole - of your life and ensures the loved ones you nominate as the beneficiaries of the policy will receive a payout. In this way, it is different to a ‘term’ life insurance policy, which only pays out if you die before a specific age or date.

Life insurance to cover IHT

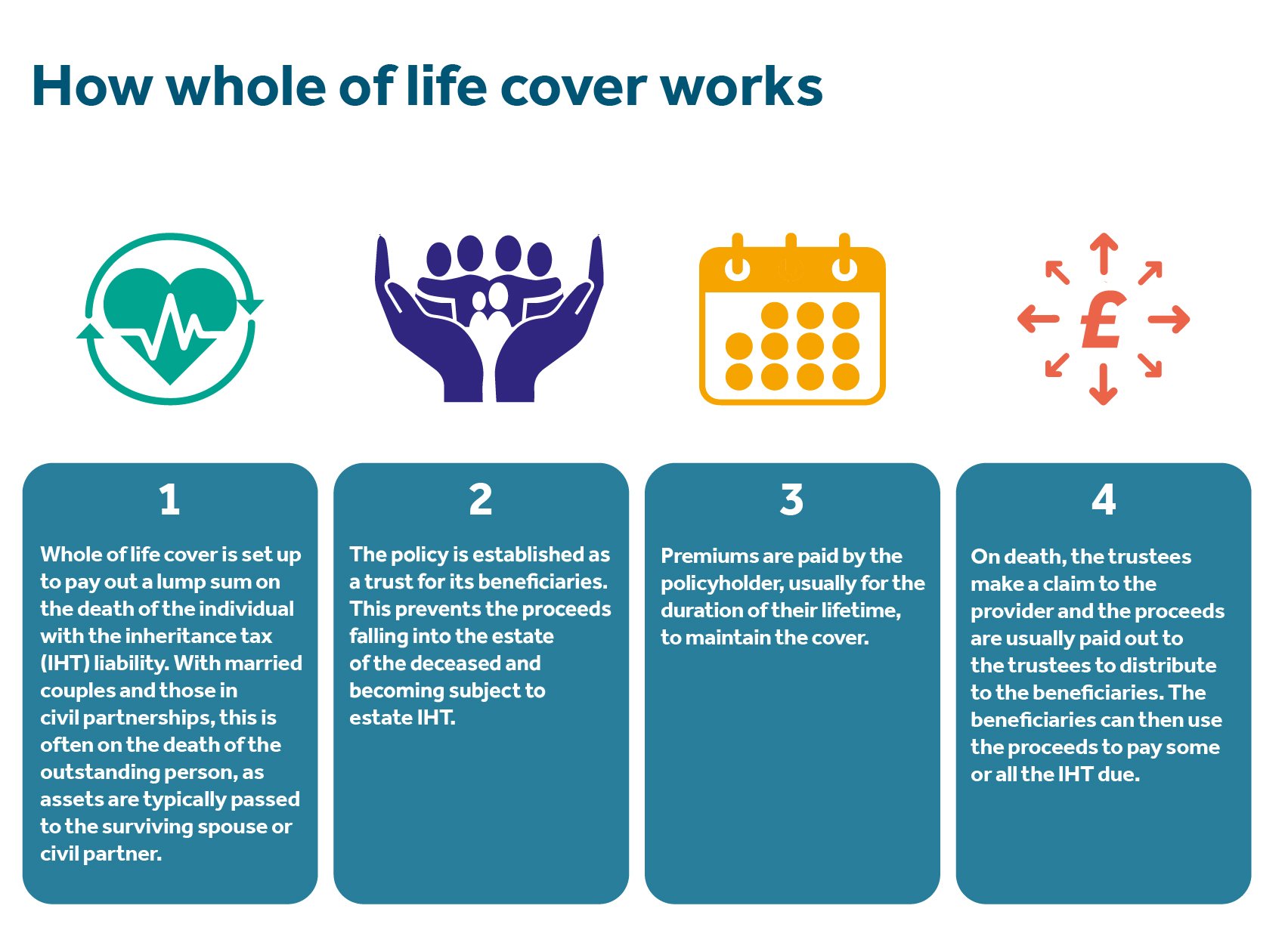

We will set up the policy for you in a trust for your beneficiaries, as this means the proceeds will remain outside your estate and they can then use this money to pay some, or all, of the IHT due.

We’re then often asked: ‘Is this expensive?’ and ‘Aren’t we just pre-paying the tax?’ So let’s explore these questions in more detail.

What does whole of life cover cost?

As a whole of life policy will always pay out (unless you stop paying the premiums or gave false medical information when applying), then the cost of the cover reflects this benefit. As such, the premiums are usually higher than term insurance plans, which do not pay out if you outlive the term of your cover.

At Canaccord Wealth, we will work with you to determine if the premium is worth paying for the benefits the policy offers, based on your personal circumstances, the value of your estate and likely IHT liability. In particular, we would need to consider your life expectancy - usually, you need to live significantly beyond the average life expectancy to justify the cost.

Does IHT still have to be paid with whole of life cover in place?

If your estate exceeds the IHT threshold, then IHT must be paid - whether you have whole of life cover in place or not.

However, because a whole of life policy is a standalone contract between you and the assurance cover provider, you can be reassured that it will not be impacted by any future budget announcements or tax changes.

Key advantages of using whole of life cover include:

- You don’t have to sell assets or invest in higher-risk products: This means you can retain control of your assets and capital for your future needs, such as care fees; or you can maintain existing investments in lower-risk portfolios

- It’s immediately effective: Unless you die within the first 12 months due to suicide or self-injury, whole of life cover will pay out no matter what; other methods of IHT planning can have periods of two-to-seven years to be effective

- Funds can usually be released before probate is granted: This offers a practical advantage as your executors may not have to sell assets to meet IHT costs

- IHT-efficient premiums: These can potentially fall within the annual IHT exemption of £3,000 or under the ‘normal expenditure out of income’ gifting exemption

- Indexation can be included: This is when the sum assured is increased annually in line with inflation, up to specified limits, to allow for increases in the value of your estate without further medical underwriting.

What else do I need to know about whole of life cover?

Whole of life cover is medically underwritten - and premiums can increase when you disclose medical conditions. Don’t let that put you off. We’ve been pleasantly surprised to see clients accepted for cover when neither of us expected it.

There’s also a risk that the premiums become unaffordable over the course of your lifetime and you might need to cancel the policy before you die. If you cancel the policy, there is no cash-in value.

It is also very important you consider the type of policy you are taking out, as some terms allow for the premiums to be increased by the policy provider, even if the sum assured stays the same.

At Canaccord Wealth, we tend to opt for guaranteed premiums so you know the cost will remain the same for life, and our estate planning advice service also comes with comprehensive cashflow forecasting that considers different scenarios. This will help you understand the affordability of the policy, including any contingency if your premiums did increase.

Finally, we always advocate regular estate planning reviews to check that your whole of life cover continues to meet your goals, especially if your estate has increased in value. Whatever happens, the capital injection will help to go some way towards easing the burden on the estate but it is worth checking.

Is whole of life cover right for me?

When you’re thinking about your estate planning, identifying the practical and meaningful outcome you are trying to achieve is what gets the right result.

A good wealth planner will discuss your needs, putting products and solutions aside, and then recommend a plan that meets your goals. They should consider a range of different options as the best solution is not always obvious.

If you wish you speak to a Wealth Planner about whether whole of life cover is a suitable strategy for you, please get in touch to arrange a free initial consultation with one of our experienced team.

*The life cover will pay out on the death of the life assured where the policy’s terms and conditions have been met.

You may also be interested in:

- Calculate your potential IHT bill

- Is there a perfect time to invest?

- Calculate your retirement money

- Our investment outlook

Need more help?

Whatever your needs, we can help by putting you in contact with the best wealth management expert to suit you.

Important information: This is for illustrative purposes only and not to be treated as specific advice. This article is based on our current interpretation of inheritance tax proposals. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity. Tax benefits depend upon the investor’s individual circumstances and clients should discuss their financial arrangements with their own tax adviser before investing. The levels and basis of taxation may be subject to change in the future.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity. This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only. The information contained herein is based on materials and sources deemed to be reliable; however, Canaccord Genuity Wealth Management makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. Canaccord is not liable for the content and accuracy of the opinions and information provided by external contributors. All stated opinions and estimates in this article are subject to change without notice and Canaccord Genuity Wealth Management is under no obligation to update the information.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.