- Home

- Investment solutions

- ESG portfolio service

- Our ESG strategy

Our ESG investment strategy explained

Investors are increasingly considering ESG (environmental, social and governance) principles alongside traditional financial factors, to create a more sustainable portfolio. We believe that companies that meet high ESG standards are likely to outperform those that don’t, sometimes by a significant margin. Equally, companies that act irresponsibly have seen catastrophic repercussions, both ethically and commercially.

Our ESG Portfolio Service enables your clients to take a more responsible approach to investing; helping them invest in funds that work towards making the world a better place, while also doing their best for their long-term financial security.

What is ESG investing?

ESG investment principles

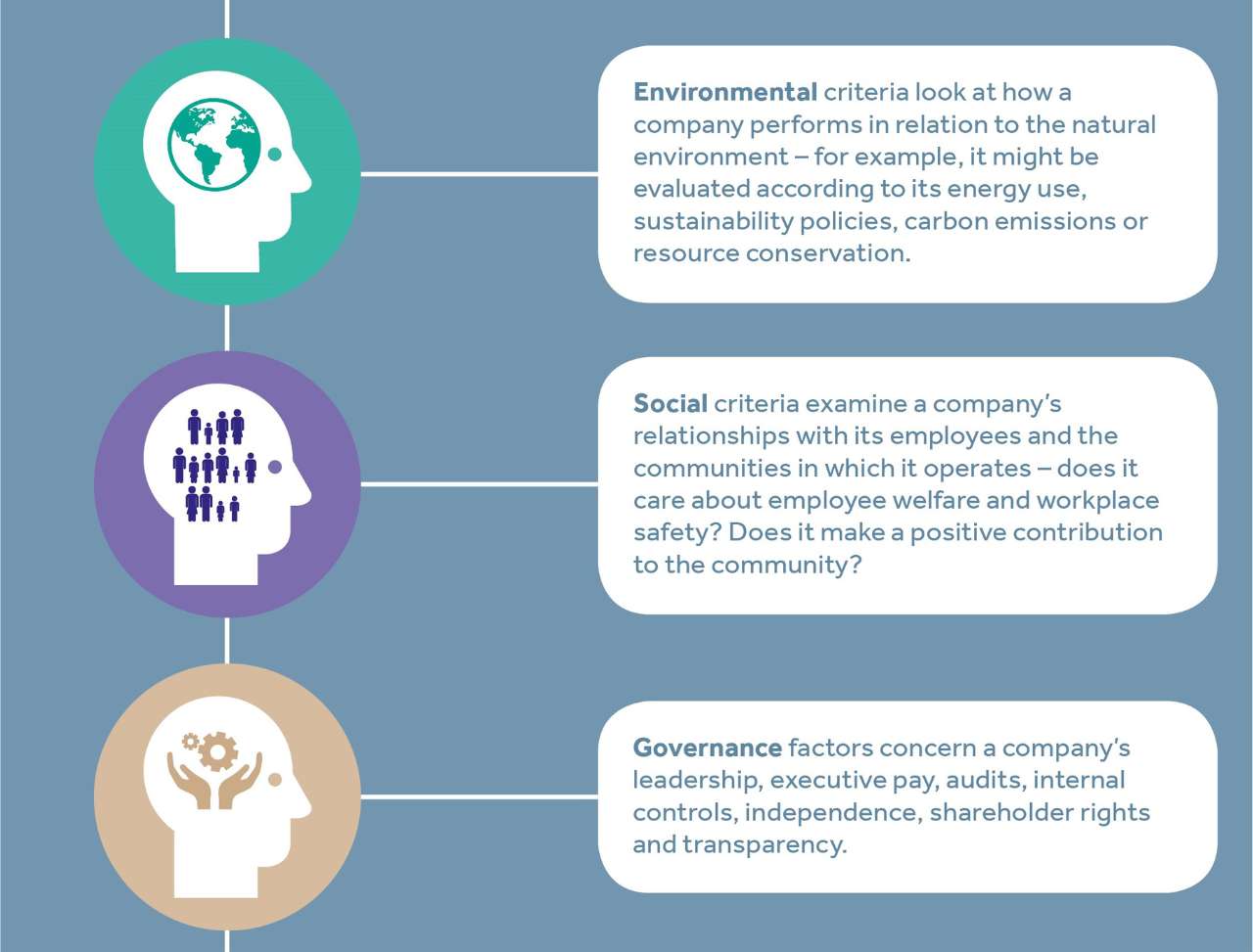

Looking at the criteria set out below allows investors to assess a company’s social and economic impact and think about how this might affect a business model over time. Businesses working in a more sustainable way, with robust policies and procedures around ESG issues may also be attractive from a risk and return perspective.

How we create our ESG Portfolio Service

Our ESG Portfolio Service offers your clients impact investing with a thematic approach.

We choose our themes by thinking about the impact they will have on both planet and people, ensuring a holistic and well-rounded approach that brings exciting investment opportunities.

Impact investing means:

- Choosing companies that we believe will have a demonstrable impact for good on the planet and the people within it

- Engaging in positive inclusion, which naturally excludes exposure to undesired sectors

- Investing where we see the potential for a positive contribution.

Our thematic approach

Identifying specific sustainable themes allows for a more specialised investment approach which enables us to pay attention to all opportunities associated with an identified, investible theme.

Our ESG themes detailed below span multiple regions, sectors, and business ecosystems. Looking for consistent exposure to a particular theme ensures the portfolio is focused on high growth and long-term economic value creation.

We believe that these themes, while having a positive impact on both planet and people, are also likely to provide favourable long-term investment returns, as sustainable practices become more and more integral to daily life – and business performance.

Investing responsibly without compromising performance

With this service, your clients invest in managed portfolios, based on our standard Managed Portfolio Service (MPS) portfolios, which we run on your clients’ behalf. This allows them to benefit from our breadth of investment expertise, which includes our ‘inflation+’ investment strategy and protection on the downside.

Our ESG portfolio is built with the same philosophy in mind: we use this inflation+ investment expertise as a base, and then invest in thematic investment funds that meet your clients’ ethical criteria. Each portfolio aims to protect and grow assets in real terms by targeting a return above inflation net of charges, over the medium to long term.

Importantly, we also look for funds that have a long and successful track record of outperforming their competitors. We aim to achieve a dual objective: generating performance while benefiting society.

Our ESG Portfolios

We offer five different Risk Profile (RP) strategies, so your clients can invest sustainably with the appropriate level of risk. Our multi-manager ESG portfolios are designed to work over a typical investment cycle of seven to ten years, so we recommend that clients stay invested for at least seven years.

Our ESG portfolios enable clients to take a more forward-looking, responsible approach to ESG issues. Your clients’ investments will benefit from the best of Canaccord Genuity Wealth Management’s thinking and long-term experience. We monitor and manage portfolios to ensure that each client’s investment risk is kept at a level that suits them through true diversification, while also investing in companies that we believe will have a positive impact on both planet and people.

Learn more about how we can help your clients

Find out more about our ESG portfolio service.

Investment involves risk. The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

Our portfolios are designed to work over a typical investment cycle of seven to ten years, so we recommend you stay invested for at least seven years.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

Meet our ESG investment experts

If you would like to know more about our ESG Portfolio Service, please get in touch. We will be delighted to give you more details.

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.